Freezing My Credit

I recently tried to freeze and check my credit with the three large credit agencies in the U.S., and I thought I’d share my experience so that it can assist others.

It was a taxing process and I’m still working on it, but a few bits were easier than I expected. The last time that I checked with the three majors was probably in 2018, so it was due time to check in and make sure my credit was frozen properly.

CreditWise (Not one of the majors)

My primary means of monitoring my credit regularly is CreditWise, Capital One’s product which I get access to via my Capital One credit card. I’ve had a great experience with it, and I don’t even remember needing to set anything up.

TransUnion: Success!

TransUnion was an easy success. My log in from five years ago worked the first time. I then requested a credit report which I got instantly, and I froze my credit.

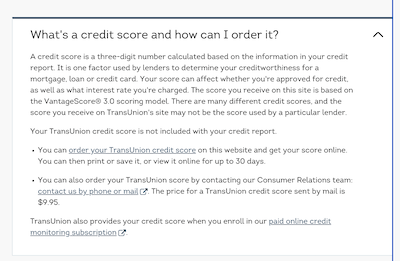

I did not get my credit score from TransUnion because it was unexpectedly (and disappointingly) a $10 charge. I felt uncompelled to pay since I could see my credit score on CreditWise.

Equifax: Failure :(

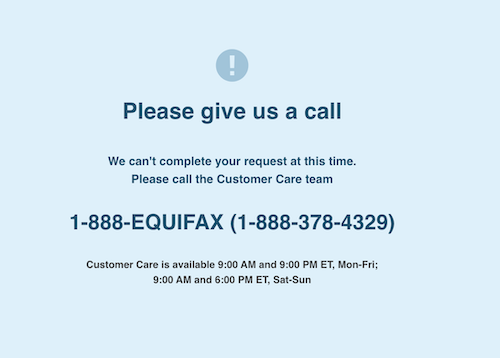

I’ve had the most challenges with Equifax. I remember struggling five years ago to make an account and calling their help line without success.

This time, I tried logging in using the email and password in 1Password, and I got a message saying I needed to call them. It was not even a message saying my password was wrong or something like that, just that I needed to call them.

I have yet to call them, but I’ll update this post when I do.

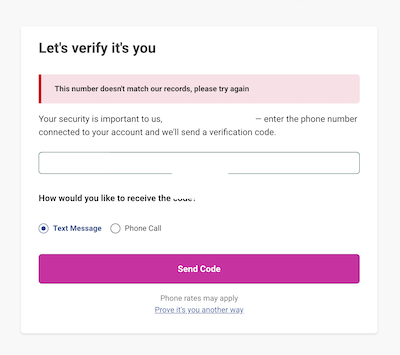

Experian: Failure :(

I thought I had good luck with Experian five years ago and that my credit was frozen, but this time I struggled. My 1Password entry had the wrong username/password/pin, and when I tried to reset my password, they said the phone number I entered didn’t match their records.

It’s possible someone else has gained access to my Experian account, but we’ll need to see. I’ll call them and update this post when I learn more.

My Recommendations

Here’s what I recommend based on what I understand1.

-

Set up and use CreditWise, especially if you have a Capital One card. I’ve had a wonderful experience with CreditWise and it gives me peace of mind regarding my credit. On CreditWise, pay particular to attention to credit pulls and amount of credit: those will indicate if someone tried to open an account in your name.

-

Freeze your credit. It’s hard and takes time and grit, but it must be done.

-

Use a password manager. Losing access to these accounts is very annoying. You’ll want to remember your passwords for the future, and because these passwords gateway access to your credit, they need to be secure. I recommend 1Password—I’ve been using it for years and love it.

-

Be careful clicking links and be skeptical of every website you visit! Even links from Google can be fraudulent, including and especially the sponsored links.

Footnotes

-

I’ve been doing tech help sessions at my local library, which has prompted me to push through bureaucratic hurdles myself so that I’m better equipped to assist library patrons. Here and there, I’m also going to try to document my experiences and tips to assist others—and my future self. ↩